RISK MANAGEMENT

Energy Markets

We work with the largest energy asset exchange in Europe.

About us

TTR Energia develops hedging strategies that fix the purchase or sale price of energy, carrying them out with the firm’s energy SWAPs. Our objective is to maximise our clients’ profits and reduce the risk of volatility in energy markets.

Through our partners, we design the most appropriate structures for competitive and secure hedging of the sale or purchase price of energy assets.

At TTR Energia we offer representation services to producers in the electricity market to strengthen their negotiation capacity with market agents.

What do we do

To combat this volatility, which represents an added business risk for both producers and suppliers, TTR Energía develops hedging strategies for its clients that fix the purchase or sale price of energy in a given period.

These strategies take the form of an energy SWAP contract.

Energy SWAPS can be negotiated to take advantage of the high volatility of this market.

PRODUCER AGENTS

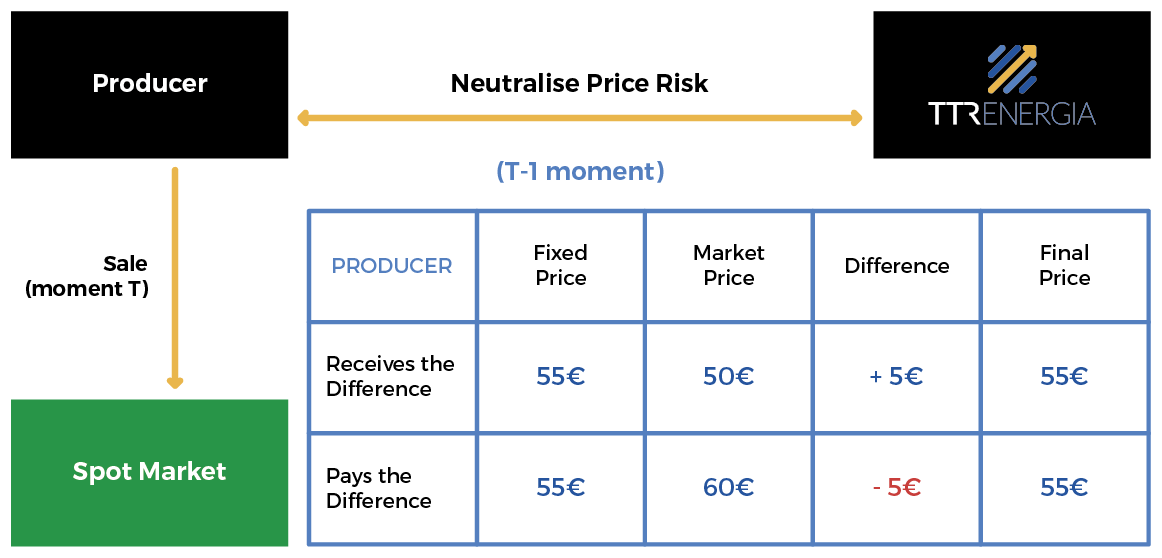

An energy SWAP contract allows the producer to fix the selling price for a future period (week, month, quarter or successive years) of the energy it produces, receiving or paying in the settlement the difference of the price previously fixed for the spot market.

RETAILER AGENTS

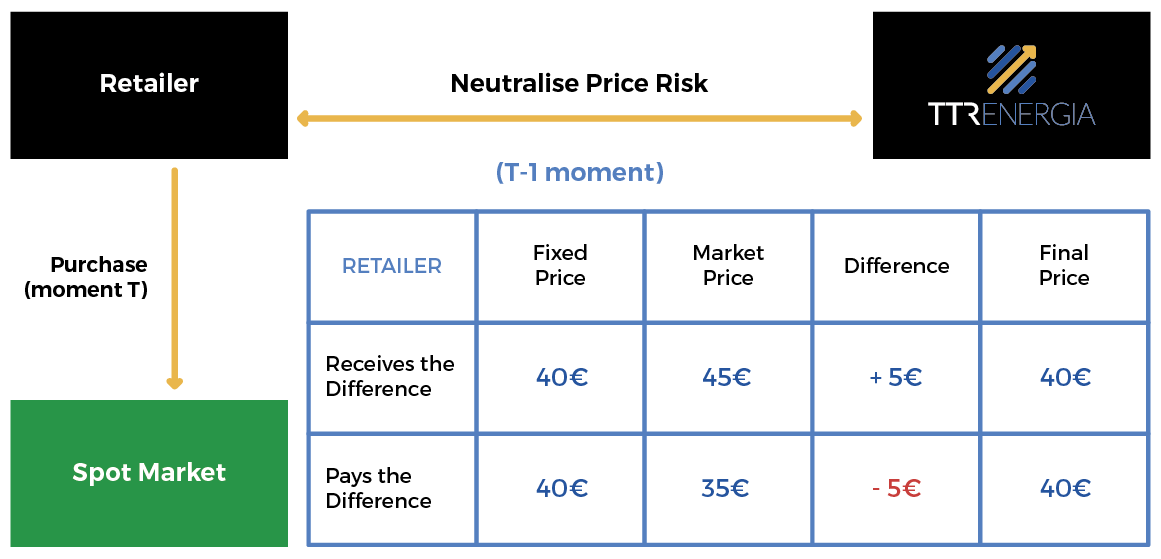

An energy SWAP contract allows the supplier to fix the purchase price of its energy for a future period (week, month, quarter or subsequent years) of the energy it markets, receiving or paying in the settlement the difference with the price fixed for the spot market.

EEX Exchange

TTR Energia operates in the energy markets mainly through EEX, Europe’s largest energy asset exchange.

EEX is the leading European energy exchange within the Deutsche Borse group. (German State Risk)

Risk Analysis

TTR ENERGIA performs a counterparty risk analysis to define the exposure and collateral for transactions.

Basic Agreement

Signing of the Framework Agreement regulating the general conditions of the operation between TTR Energia and the counterparty.

Transaction

Based on the market prices on the EEX exchange, the price to be fixed in the SWAP is defined.

Confirmation

The annex to the Framework Agreement containing the specific conditions of each transaction (product, quantity, guarantees, price, maturity, etc.) is signed.

Clearance

Simple settlement system by difference.

Contact us

Leave us a message and we will contact you as soon as possible.

Phone

+34 93 118 58 94

Address

Carrer de la Fontsanta, 46 – Planta 1

08970 Sant Joan Despí (Barcelona)